when the music stops

It's been a week of nonstop texts between groups of investor friends, and founder-VC calls to discuss the macro. Is winter coming? If so, what do we do? Let's break it down in the open.

what is happening?

Year to date, the NASDAQ is down 15% (and down more from November all-time highs). My personal portfolio, heavily skewed toward high-growth tech, is down quite a bit more than that. Fear is in the air.

What drives exaggerated, downward market cycles? Some trigger leads a few investors to conclude that pricing is irrational, and they begin to sell. The movement is reinforced by investor psychology. As asset prices decline, more investors begin to inspect and then doubt their positions, and the expectations implied by asset pricing become less believable under pressure. Declining prices put structural pressure on overextended investors in the form of margin calls and redemptions. Your average investor becomes more driven by fear-of-missing-out than by greed, which further accelerates selling. Buffet is famous for saying, "I like burgers, and when burgers are on sale, I eat more burgers." But when burgers go on sale, and especially when everything goes on sale, most investors decide they don't like burgers anymore.

Some adjustment was inevitable and healthy. Asset prices have been inflated by the "Covid Boom." Over the course of the pandemic, the government distorted the markets more than they have in the past 50 years. They aimed a $1T+ firehose of free and cheap money, comprised of direct stimulus, tax breaks, near-zero interest rates, quantitative easing, at the American economy, and it worked.

However, in the face of the highest inflation the US has seen in 40 years, Fed Chairman Jerome Powell has recently signaled the end of of free and cheap money, with faster-than-expected quantitative tightening and interest rate hikes to come. As interest rates go up, asset prices come down, and especially high-growth equities prices. In theory, a public company stock is valued as the sum of all their discounted future cash flows, where the discount rate applied to those future cash flows is some risk free-rate plus a "risk premium" that reflects the risk of that asset. A big hike in the risk-free interest rate significantly decreases the value of a growth stage company, where the lion's share of the value is cash flows in the distant future.

how did we get here?

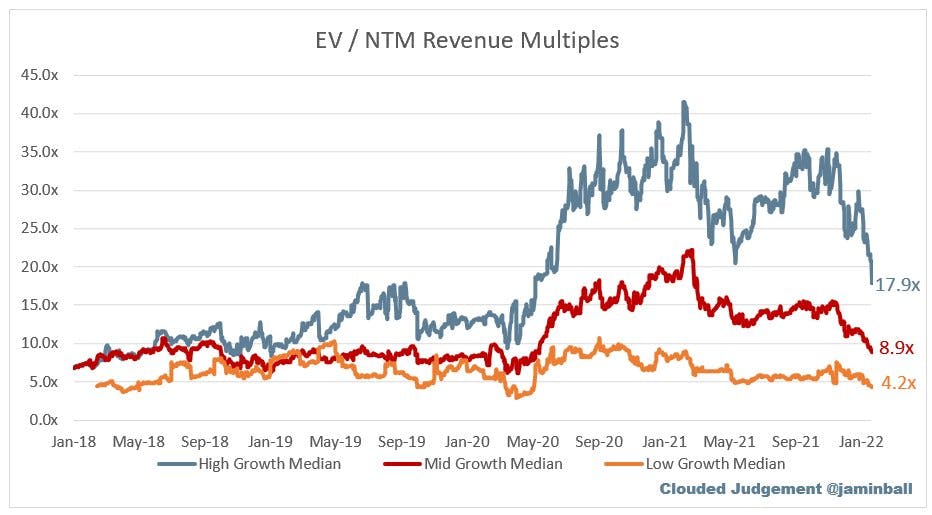

To put in context where we are, despite the pullback, tech companies are still at relative highs vs. historical average multiples prior to 2021.

For years, many tenured technology investors would say that solid, relatively fast-growing software companies, public or private, should be valued at 6-8X forward revenues. As the market's understanding of software companies has matured, increasing numbers of investors capitulated to higher and higher prices. The prices paid by investors have gone up almost monotonically for a decade for the most promising technology companies. There is real truth to the claim that modern software businesses can be better businesses than most investors understood.

It is now common knowledge that the very best (and quite rare) software companies are extraordinary compounders: they have high margins, high stickiness and efficient growth. Their markets are very deep and secular (how big is the TAM for Stripe's core product?) and they are often run by innovators who are highly motivated to expand into new opportunities for growth (Shopify has become a financial services company in recent years). If you don't talk yourself out of selling Amazon for 20 years, it keeps growing and growing and growing.

At the same time, a lack of investable opportunities outside of technology has driven more and more capital into technology investing. Consensus investment views drive returns out. The more commodity the investing idea, the less money you can make. SaaS metrics analysis is somewhat a commodity business today.

Given that, investors began to take on more and more risk, either by making more speculative investments, by going earlier, and especially by paying higher prices. They justified it as "paying ahead" several years for the compounders. Venture is a hits-driven business, and returns are asymmetric, where one winner company can make up for ten failed attempts. Bigger funds led to the side benefits of more market share and more fees for investors, and soon, investors were paying 200X+ ARR, or "any price" for hot companies. Inflated prices quickly trickled down to the earlier stages as well. More early stage companies were priced as "likely hits."

why are investors stressed?

Significant market dips mean that investors with large public portfolios at high cost bases are faced with losses. At best, that naturally creates nervousness, and a defensive posture. At worst, investors face margin calls and redemptions, or as the crypto frens like to say, it's time for those investors to work on their McDonalds applications. This effect becomes more pronounced the later-stage the investor goes because of loss aversion. An early-stage firm whose public holdings fall 25% in value and whose portfolio falls from an 8X to a 6X multiple-of-money is a feeling a lot less pressure than a crossover firm whose public stocks are underwater and whose private holdings will go public at a price well below their cost basis. The cardinal sin in the hedge fund world is losing people money.

It is often said that it is "hard to overpay for the best companies." That's true -- but my hunch is that the cause of some stress now if investors doubt that they've truly chosen the best companies, and they've potentially bought into too broad a sweep at a local pricing maxima for the power law to work in their favor.

how operators can plan for uncertain capital availability

Given the spillover impact of people's public portfolios and the realization that the music could stop, some investors are pulling back. They "aren't sure how to price opportunities" right now.

Whether or not winter is coming, this is a great reset moment even for companies that don't need to fundraise immediately. Founders and operators have begun to consistently expect the new high-water mark multiples they hear of in the market. However, chasing the highest intermediate valuations comes with risk. Getting ahead of your skis risks a flat or down round, and investors self-selecting out of your next process if they know the valuation you're sitting on. It's particularly risky if a company overemphasizes valuation as validation, rather than growth or customer happiness. The less tethered your valuation is to your traction, the further the ground you need to cover with execution before you meet the market again. The public markets are the final arbiter on price, and dislocations from the public markets can only be temporary.

If easy money is becoming scarcer, founders and operators can take this as an opportunity to raise the bar for execution, and build better, not just bigger, companies. Startups often fear that trimming investment means they will fall behind in market share (and it can). But acting as if cash is free can also bake in unsustainable cost structures that become harder and harder to fix at scale. There's a balance to be actively struck.

While the advice of, "grow faster, burn less" in reaction to an annual plan is frustrating, it is part of the execution path to being a compounder. Don't hunker down, but do raise the bar for lean and creative execution. Scenario plan for managing cash and normalize the idea of adjusting spending and headcount based on the cost and availability of future capital. If you are building a technology disruptor, that disruption will still be happening a year from now. Predicting whether this is a brief correction, or if winter is coming, is a fool's errand. The best leaders will build a muscle of adaptability and a culture of long-term orientation, and be transparent with their teams about the uncertainties in the environment.

with my investor hat on, too

For investors, the fear and the "flight to obvious quality" is also an opportunity. Willingness to "be greedy" and take shots during times of uncertainty can generate outsized returns. As one example, Silver Lake's investment in AirBnB early in the pandemic during a time of "distress" was a stroke of genius. The market is not an intelligent force. If NO investor is willing to invest in a particular sector because the multiple has imploded and they've lost money, it doesn't mean there are no opportunities in that sector, it just means investors fear they've mispriced it for a period. If ALL investors want only to invest in growth-stage companies that experienced 3X year on year growth from $5 to $15M of ARR, 80% gross margin, and 125% NDR with a holding period of 3-5 years, they are performing a commodity screen. Great companies are much more than the sum of their metrics at any point in time along the way. Figma at $1.5M in ARR wasn't yet an obvious metrics winner. If you didn't understand its key growth loops and the strength of the team, you could have criticized it for small deal sizes, and high headcount in EPD and community. The best companies during this time will get leaner, more long-term oriented, and potentially have different expectations on intermediate valuations, but will be no less ambitious.

If I liked burgers at $100, I'll eat more at $25.