BNPL for Businesses

The Potential for Better Access to Business Payment Financing

Written with my partner Corinne Riley, first published on the Greylock blog

Consumers no longer view digital payment as one option among others, but as the expected default.

This expectation has carried over to “buy now, pay later” (BNPL) financing that has become commonplace over the past five years, and consumers have come to view the ability for seamless digital financing, order tracking, and interactions via mobile-friendly channels as a given.

For business-to-business commerce, however, the innovation has not been so swift. The cumbersome, paper-intensive payment process that consumers have all but forgotten still persists in the B2B commerce world. Financing is laborious and underwriting models poor.

The high friction associated with the use of checks and ACH that still dominate B2B payment methods – unstructured communication channels, high operational toil across multiple systems, and manual reconciliation – have left businesses eager for modern tools.

"We believe adoption of online transactions, digital financial operations, and digital payments in B2B is inevitable, and we are looking to invest across the landscape. "

Yet the path to this more efficient, data-rich, automated, lower cost-to-transact future is complex.

Untangling a portion of fintech will let us identify areas of opportunity for innovation. Let’s dig in to discuss one hot topic in fintech: B2B payments financing.

“B2B BNPL” is essentially a rebranding of the centuries-old process of invoice factoring. BNPL was a hit in consumer markets however many underpinnings of its success need to be re-thought in B2B, because offering instant, digitized financing continues to be a challenge from a product, distribution, and risk assessment perspective.

That said, over the next decade we expect the B2B shift towards online transactions to accelerate, and companies who are able to lower the customer barriers to purchasing will win market share.

THE CURRENT STATE OF NET TERMS IS FLAWED

This shift towards a B2B financing ecosystem that looks more like the consumer commerce ecosystem is being led by entrepreneurs who deeply understand the myriad flaws within the current state of B2B financing as it is today. At the most foundational level, financing options today are simply a cash flow burden shift to suppliers.

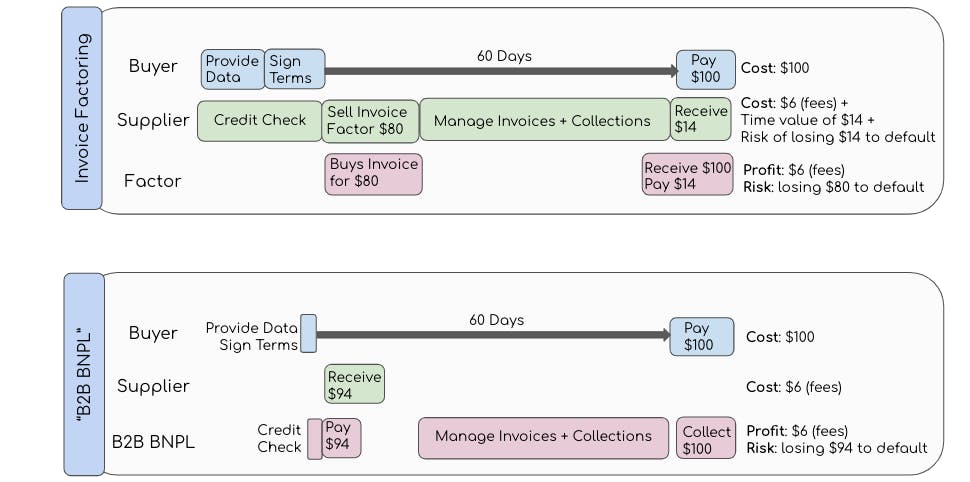

In many B2B transactions, “net terms,” or the option to pay after 30, 60, or 90 days, is the status quo. The ability to purchase on credit lowers buyer cash flow requirements and therefore has the potential to increase overall volume for the seller. However, a naive approach to financing simply shifts the cash flow burden to the supplier. This is where historically invoice factoring, or the practice of selling invoices at a discount to a third party in exchange for upfront cash, has been a valuable tool.

When a supplier offers traditional net terms to a customer, they go through a credit rating process (pulling data from Dun & Bradstreet, Experian, or Equifax) and then perform “trade references” to determine the credit worthiness of their potential customer. The supplier is effectively offering a short-term loan, thereby taking on risk that the customer will default or pay late, and incurring additional administrative costs of managing complex accounting.

Since many companies don’t have the cash flow to offer these “loans,” they turn to invoice financing or factoring. They sell the invoice to a “factor” at a small discount (2-6%) in exchange for 80% of the invoice in upfront cash, and the remainder when the invoice is paid.

Example:

WholeSaleCo delivers widget X to ACME Inc, and issues an invoice to ACME for $100. After WholeSaleCo does a business credit check and runs trade references, they decide to offer ACME Inc net 30 terms. WholesaleCo then submits the outstanding invoice to a FactorCo. FactorCo gives $80 to WholeSaleCo upfront for the purchase of the invoice. After 30 days, ACME pays the $100 to a reserve account. FactorCo takes a fee of ~$4 (between 2-6% typically) and pays the remaining $16 to WholesaleCo.

The scenario described is not only a bad ‘sale’ experience for the customer (who has to provide unstructured information over email, offer trade references, and wait for credit approval), but also a cumbersome, expensive, and risky burden on the supplier. Many markets and companies are unable to use factors entirely due to their smaller transaction sizes.

OPPORTUNITY: SHIFTING THE BURDEN AWAY FROM SUPPLIERS

New players are emerging in B2B factoring who effectively absorb much of the cash flow burden and risk away from the suppliers by acting as a critical intermediary – and technical infrastructure – between the payer and payee.

So-called “B2B BNPL” companies embed themselves in the supplier’s sale process and offer quasi-instant net terms to end customers. Suppliers get paid 100% of the invoice up front (minus the fee, ~2% of invoice per month) and are not responsible for collecting payment. The BNPL company therefore manages all credit decisioning, bears default risk, and manages collections, while making the net terms process easier and faster for end customers.

A number of venture-backed companies have emerged worldwide to build this product (such as Balance, Slope, Two, Vartana, Resolve, Billie, etc) and we expect the pace to continue over the coming years.

WHERE B2B BNPL MOVES THE NEEDLE

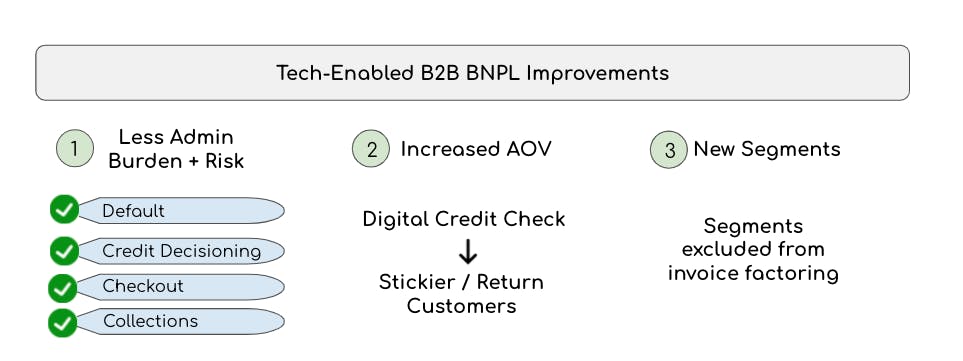

B2B BNPL companies take on the burden and costs of underwriting and administrating trade credit, in theory creating customer value in three ways. Let’s dig deeper into each.

DECREASE ADMINISTRATIVE COST TO COMPANIES

By outsourcing the net terms process to a B2B BNPL company, suppliers are able to significantly decrease the administrative burden that accompanies decisioning credit and collecting invoices. This benefit can be disaggregated into four parts:

Absorbing default risk

With traditional invoice factoring, suppliers are still exposed to credit / default risk because a portion of contracts aren’t received until the customer pays in full. B2B BNPL companies absorb that risk entirely by paying the full cash payment upfront and are able to do so because they bring the credit decisioning and risk burden in-house.

Improving Credit Decisioning

Shifting the burden of traditional business credit checks from suppliers to third partiers isn’t a huge factor for two primary reasons.

- For one, suppliers only do credit checks for the initial sale; once the relationship is established, subsequent purchases can be done with no subsequent credit check. Many B2B business relationships are “repeat.”

- Secondly, sellers may go through a simplified diligence process for established brands.

Still, even naively transferring risk assessment ownership from the company to the B2B BNPL player is a win-win because it alleviates the supplier of the burden that is non-core to their business.

A much bigger unlock would be fundamentally improving business credit decisioning. The current business credit scoring system is less reliable than the consumer credit system, and as such first-generation B2B tech enabled lending companies such as Kabbage and On-Deck struggled with repayment. The data used to underwrite trade credit today is very limited, and it is not hard to imagine better credit underwriting based on real-time financial data or richer transaction history.

Improving Checkout

We are still very early in B2B purchasing and payments automation, and there’s an opportunity to both improve conversion and dramatically reduce operational toil for both buyers and sellers. The future will certainly look more like “one-click” Amazon-style checkout, with programmatic payments, integrated Affirm/AfterPay like options and automated accounting and other internal financial workflows based on captured transaction context.

Managing Collections

Most companies would prefer to outsource the complex administrative burden of collections. Growing companies have been built on the promise of streamlining AR collections and payments (e.g. Melio), so bundling it with trade credit as an entry wedge seems like a compelling opportunity.

INCREASING AVERAGE ORDER VOLUME (“AOV”) THROUGH BETTER CUSTOMER EXPERIENCE

Most B2B BNPLs claim they help suppliers increase AOV and stickiness. However, we would challenge that notion in markets where net terms are already the status quo, and question how much a better customer experience affects overall demand unless they are driving up application, approval, take up rates, and economics.

On the consumer side, BNPL actually shifts demand because:

- The actual economic terms of their purchase is changing (they used to have to pay upfront and now they don’t)

- Consumers are more sensitive to UI improvements particularly for discretionary/impulse purchases (better checkout conversion rates).

However, in B2B markets where net terms are ubiquitous for large buyer/supplier relationships and actual economic terms are not changing, small changes in purchasing UX are unlikely to have a significant impact.

We believe tech-enabled B2B BNPL can affect top line for suppliers in the following ways:

- Speed: if a rapid financing process increases buyer application/takeup rates

- Administrative Burden: if collections are settled programmatically with more automation and better data/visibility for suppliers

- Flexibility/Economics: if B2B BNPL can offer better rates, longer terms, and new payment methods (e.g., better fees for early payback)

- Increased Approval Rate: financing today is often only offered to large trading partners, and access could be expanded to the long tail

- New Markets: if B2B BNPL is offered in markets where net terms are not common today.

BROADENING FINANCING ACCESS, OPENING NEW MARKETS

A potentially significant unlock lies in enabling businesses to provide financing in segments and markets that were otherwise excluded from net terms and invoice factoring – broadly smaller ticket items and smaller buyers with less repeat buying history with a single supplier.

The lack of financing is a short term cash flow constraint that holds many businesses back from further growth.

As an example, a consumer durables company selling to doctors with average ticket prices of ~$7K where customers don’t want to use personal credit to purchase the equipment, but where it’s untenable for the company to externalize the credit risk.

THE CHALLENGE OF DISTRIBUTION

Another contrast to the consumer purchasing world is a major blocker: there exists no checkout page (no Shopify!) to integrate into. BNPL inherently happens at the “point-of-sale” but today most B2B transactions still do not live online.

In the long arc of technical progress, B2B transactions will inevitably shift from email, phone, and even faxed invoices to software and digital payment rails, embedded instant, flexible financing could be a trigger to accelerate payments digitization. In our hunt for investable opportunities, we’re focused on distribution for B2B BNPL of four types:

- Marketplaces: B2B Marketplaces embed B2B BNPL at checkout for all their brands. Some marketplaces might build this themselves – Faire very notably provides Net 60 terms in-house.

- eCommerce: Many manufacturers are opting to sell directly to their end customers through their websites.

- Distributors: Since distributors are getting continuously squeezed by manufacturers trying to improve margins, they’ve had to significantly improve offerings and services. Embedding terms may improve customer satisfaction and purchasing, particularly if coupled with ‘smart’ software like Recurrency that allows distributors to anticipate customer reorders, automate upsells, and optimize pricing.

- Offline-Friendly: For ‘offline’ sales, the rep can send customers a payment link where they fill out basic company information so that the B2B BNPL co can assess the credit and offer terms.

Apart from point of sale, startups attacking B2B financing can specialize by vertical (or set of similar verticals) to build more specific features and become more intelligent in risk assessment.

Examples of Vertical Specializations:

- Ecommerce Merchants (Settle, Clearco offers fast funding for at e-commerce brands)

- Food (Marketplaces such as Vori or Choco are great example customers for B2B BNPL)

- Construction (for example, Flexbase is a construction-specific card with no personal liability)

- Health Equipment (Historically large segment for both financing and leasing, where we expect B2B BNPLs to focus on)

WHERE B2B BNPL GOES FROM HERE

While we’re beginning to see startups address demand for better B2B financing, it is a large and global opportunity, and we’re in the early innings.

We predict there will be several geo-specific companies, taking into account local differences from payment methods to tax reporting. There are also many related areas fertile for innovation: the checkout experience, AP/AR automation, and moving transactions to marketplaces. We’re excited to see B2B BNPL companies with a point of view on how to distribute to their customer vertical or segment of interest, who are building sticky workflows around AR management, and who are innovating in underwriting. Financing is the engine of business growth.